Menu

Newsletter

Sign up to our newsletter

Email David Kirk direct by clicking on his name.

Usually, the quickest and cheapest method to close a company with debts is liquidation. This process is called Creditors Voluntary Liquidation or “CVL”.

This decision to liquidate is taken by a majority of the company directors at a meeting.

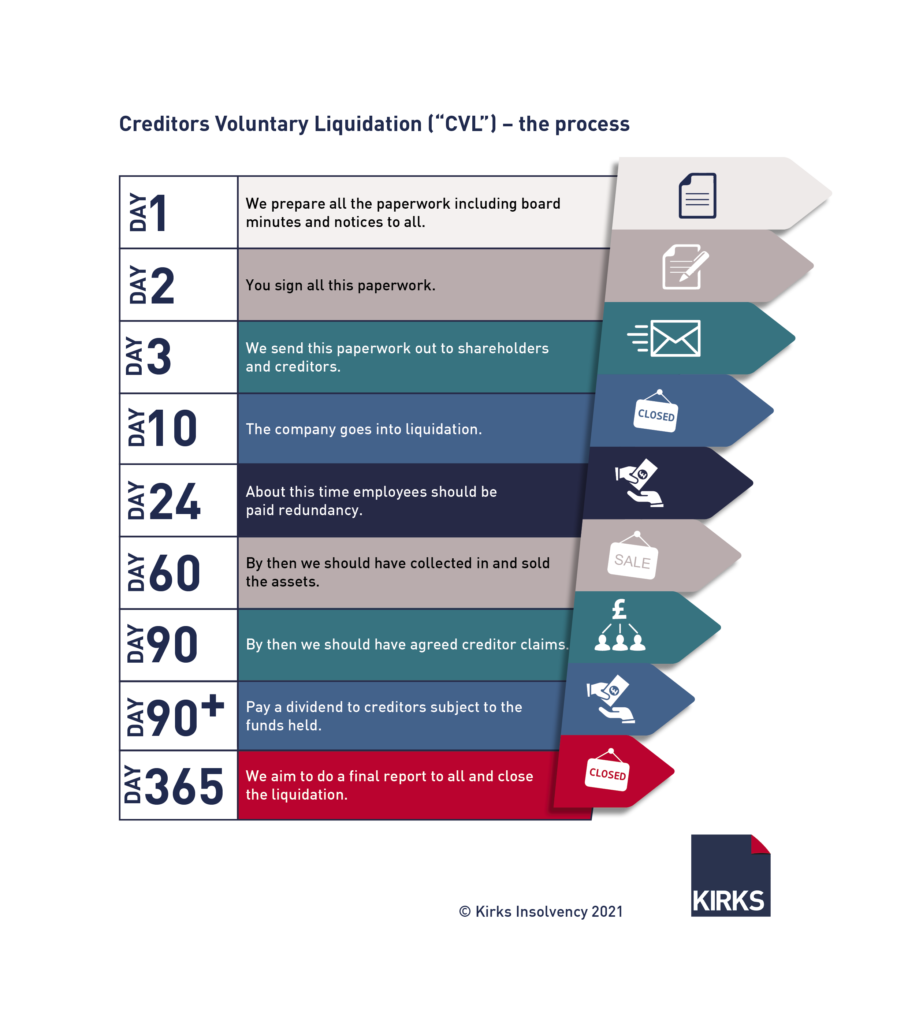

The whole process from instructing your insolvency practitioner, to the date of liquidation usually takes about 10 to 14 days.

Liquidation does write off any Bounce Back Loans as they are not personally guaranteed. this is one of our most frequently asked questions with regards to the Creditors Voluntary Liquidation process.

Everything to liquidate can be done online and we send you the paperwork to sign via Adobe Sign, so you have your own copy. There is no need to print any documents and post them to us.

We will send you a list of what we need. This includes a list of creditors, assets, employees and other financial information we need.

If you want to see the list as a PDF CLICK HERE.

If you’d like to discuss anything you can call us, we can arrange a virtual meeting or a meeting at our office or your premises. We then agree with you the target date of actual liquidation – usually within 7 plus days. We then prepare all of the paperwork for the directors to sign. As liquidation is a three-stage process this paperwork includes:

The notice to creditors is for a deemed consent liquidation. This means there is no creditors meeting – although creditors can request one if more than 10% want a meeting. The meeting can be a video call or in person.

We prepare a report to creditors and shareholders to send out before the date of liquidation. We publish this report online with access by a password only.

We take the pressure off you during this period and deal with your creditors. We also help the employees make their redundancy claims from the Government.

The company then goes into liquidation on the target date.

After the company has gone into liquidation, we carry out the following tasks:

Our usual aim for a less complex liquidation is to close the case and have paid out any creditors by the anniversary date.

If you would like to know more about the five stage process over the life of a liquidation please download this TWO PAGE GUIDE or have a quick look at the two minute video below.

CVL is a relatively cheap process compared to other insolvency routes such as Administration or a Compulsory Liquidation which may involve legal fees.

Kirks charge a fixed fee to liquidate the company of between £3,000 to £5,000 plus VAT (depending on complexity) and can be paid using company assets.

The lower end of the fee rate is charged for smaller companies with no employees and only a few creditors.

We or your chosen Insolvency practitioners are paid post liquidation (using company assets).

Please contact us with any questions you have or if you would like to arrange a call or meeting.

David Kirk says:

“We provide a nationwide service and take care of everything. We act quickly and are helpful and supportive. We return your emails and telephone calls.”

You can also email David direct if you have any questions on david@kirks.co.uk

“They promised a straightforward process and certainly delivered – I highly recommend the team at Kirks.”

Danielle F

“Kirks offered a cost-effective and reliable service. They were responsive to any queries/issues in the winding-up process – thank you.”

Patrick T

“A fixed fee arrangement provided us with reassurance and David explained the process clearly to us at the outset. A very professional service all round.”

David M

“Kirks provided a very efficient and cost-effective service. They offered support and advice throughout the process and made prompt payments. It was a very professional and helpful service.”

Richard T

“I had already met with a number of other insolvency practitioners none of whom I considered to be as clear cut and up front as David. The liquidation was executed quickly and professionally and I really am happy.”

Anon

Sign up to our newsletter

Simply fill out the short form below and I will get back to you.

Licensed Insolvency Practitioner

Simply fill out the short form below and I will get back to you.